inheritance tax rate colorado

Tax resulting from the death transfer. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

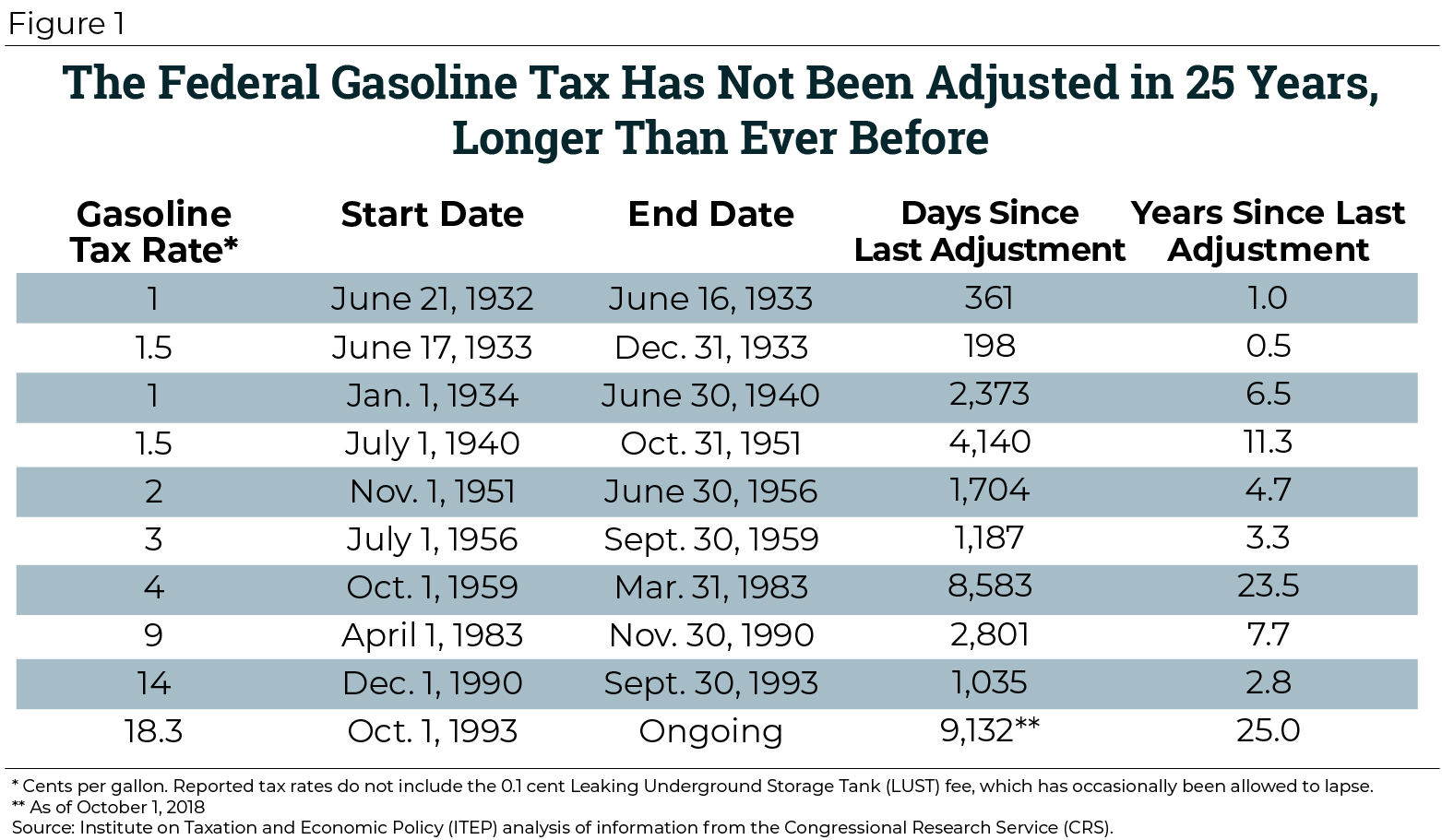

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

As with other wholesale taxes it is assumed most of this cost is passed on to.

. Maryland is the only state to impose both. Colorado also has no gift tax. If your taxable income is 496600 or.

Twelve states and Washington DC. The average local sales tax rate across the state is a bit higher than in Phoenix at 273 percent. Colorado has a flat income tax rate of 455.

For full details refer to NJAC. Income Tax Range. California tops out at 133 per year whereas the top federal tax rate is currently 37.

For example California levies a 965 per ounce tax on marijuana flowers a 287 per ounce tax on marijuana leaves and a 135 per ounce tax on fresh plant material. Theres no need to stress about an estate tax or inheritance tax in Colorado as neither is imposed. It now ranks 39 th in the property tax component of the Tax Foundations State Business Tax Climate IndexThe property tax component assesses state and local taxes on real and personal property net worth and asset transfers.

You can file Form 1040-X Amended US. The Center Square Iowa dropped a place in a business property tax ranking this year for the first time since at least 2019. For example the sales tax rate in Phoenix is 23 percent.

No Estate Tax was imposed for decedents who died after January 1 2018. The 29 state sales tax rate only applies to medical marijuana. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

Case in point. Plan your estate carefully those worth more than 1 million will be taxed at a 10-16 rate. States with this type of tax also typically set different rates for different marijuana products.

Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR. The federal gift tax exemption is 15000 per recipient per year for 2021 and 16000 per recipient per year for 2022. The rate threshold is the point at which the marginal estate tax rate.

That tax rate is 15 if youre married filing jointly with taxable income between 80000 and 496600. Thats an estate tax. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes.

Although both taxes are often lumped together as death taxes Twelve states and the District of Columbia have estate taxes as of 2022 but only six states have an inheritance tax Maryland has both taxes. Reporting and tax rules may apply to the asset. State levy is 485 but mandatory 1 local sales tax and 025 county option sales tax are added to the state tax for a 61.

1826-111 - 1125 Waivers Consent to Transfer. See Form 1040-X Amended US. Impose estate taxes and six impose inheritance taxes.

A proportional tax is a tax imposed so that the tax rate is fixed with no change as the taxable base amount increases or decreases. The federal estate tax goes into effect for estates. Individual Income Tax Return Frequently Asked Questions for more information.

There is no estate or inheritance tax in Colorado. In Kentucky for instance inheritance tax must be paid on any property in the state even if the heir lives elsewhere. Diesel fuel is taxed at a rate of 205 cents.

Even though California wont ding you with the death tax there are still estate taxes at the federal level to consider. When added to the state sales tax rate the effective sales tax rate in Phoenix is 79 percent. The United States does not impose inheritance taxes on the beneficiarys receipt of a bequest therefore there is no US.

Also the United States also does not impose an income tax on inheritances brought into the United States. Proportional describes a distribution effect on income or expenditure referring to the way the rate remains consistent does not progress from low to high or high. Denver and a few other cities in Colorado also impose a monthly.

The gas tax in Colorado is 22 cents per gallon of regular gas one of the lowest rates in the US. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013.

All the same federal tax rates are typically higher than state taxes. Local municipalities will add their own sales tax rate to the states rate. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

The amount of the tax is in proportion to the amount subject to taxation. Colorado Capital Gains Tax. The inheritance tax is not based on the overall value of the estate.

Funeral costs average 8132 and medical expenses correlated with dying generally total 14536. Delaware 23294.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Taxation In Castle Pines City Of Castle Pines

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

How Is Tax Liability Calculated Common Tax Questions Answered

How Much Do Millionaires Pay In Taxes Quora

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Taxation In Castle Pines City Of Castle Pines

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

Individual Income Tax Colorado General Assembly

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Colorado S Real Estate Tax Rate At The Lower End Nationally Denver Business Journal Estate Tax Colorado Real Estate Social Media Marketing Experts

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

States With Highest And Lowest Sales Tax Rates

How Do State And Local Individual Income Taxes Work Tax Policy Center

Estate Tax Rates Forms For 2022 State By State Table

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute